Are you ready to embark on a journey towards financial freedom? If you’re seeking a reliable and accessible method to make money while you sleep, then look no further than dividend stocks. In this beginner’s guide, we will explore the world of dividend stocks and show you how they can be your key to generating a stable and consistent passive income. So, buckle up and get ready to discover the power of investing in dividend stocks – it’s time to put your money to work for you!

Introduction

Are you looking for a reliable and long-term investment strategy that can generate passive income? Look no further than dividend stocks. In this beginner’s guide, you will learn everything you need to know about making money with dividend stocks and how to create a steady stream of income that can grow over time.

So, grab a cup of coffee, sit back, and let’s dive into the world of dividend stocks.

What are Dividend Stocks?

Before we delve into the strategies and techniques of making money with dividend stocks, let’s first understand what dividend stocks actually are. Dividend stocks are shares of companies that pay a portion of their earnings back to shareholders in the form of dividends. These dividends are often paid out on a regular basis, such as quarterly or annually, and can provide investors with a consistent source of passive income.

Why Invest in Dividend Stocks?

One of the biggest advantages of investing in dividend stocks is the potential for generating passive income. Unlike traditional investments that rely solely on capital appreciation, dividend stocks allow you to earn money regularly, regardless of the market’s ups and downs. This income can be reinvested, providing an opportunity for compounding returns and long-term wealth creation.

Additionally, dividend stocks can offer a hedge against inflation. As companies increase their dividends over time, your income potential grows, helping to combat the erosion of purchasing power caused by rising prices.

How to Research Stocks for Dividend Investing and Passive Income

Now that we’ve established the benefits of investing in dividend stocks, it’s important to know how to research the right stocks to maximize your passive income potential. Here are some key steps to consider:

-

Read all the financials: Analyze a company’s financial statements, such as the balance sheet, income statement, and cash flow statement. Look for companies with a strong financial position, stable earnings growth, and a solid track record of dividend payments.

-

Look for companies with dividend growth: Seek out companies that have a history of increasing their dividends over time. Dividend growth is a sign of a company’s financial health and its commitment to rewarding shareholders.

-

Consider dividend yield: The dividend yield is a ratio that shows the annual dividend payment relative to the stock price. Look for stocks with a reasonable yield that aligns with your income goals.

-

Evaluate payout ratios: The payout ratio is the percentage of a company’s earnings distributed as dividends. A lower payout ratio indicates that a company has room to increase dividends in the future.

-

Diversify your dividend stocks: It’s essential to diversify your dividend stock portfolio to spread out your risk. Invest in companies from different sectors and industries to mitigate potential losses.

Websites for Finding Good Dividend Stocks

Finding the right dividend stocks can be challenging, but luckily, there are several websites that can help simplify the process. Here are a few worth exploring:

-

Dividend.com: This website offers a vast database of dividend-paying stocks, customizable screening tools, and educational resources to help you make informed investment decisions.

-

Seeking Alpha: Known for its extensive coverage of the stock market, Seeking Alpha provides analysis, news, and insights into dividend stocks. Their community of contributors offers diverse perspectives that can enhance your research.

-

Yahoo Finance: Yahoo Finance provides comprehensive financial data, news, and research tools. You can screen for dividend stocks based on various criteria and access real-time market data.

Strategies for Making Money with Dividend Stocks

Now that you know how to research dividend stocks, it’s time to explore some strategies for making money with them. Here are a few effective approaches:

-

Dividend Reinvestment Plan (DRIP): By enrolling in a DRIP, you can automatically reinvest your dividends into additional shares of the company’s stock. This strategy allows you to compound your returns over time and accelerate the growth of your portfolio.

-

Long-term investing: Dividend stocks are best suited for long-term investors who have a time horizon of several years or more. By holding onto your dividend stocks for an extended period, you can benefit from growing dividends and potential capital appreciation.

-

Dividend stock ETFs: Exchange-traded funds (ETFs) that focus on dividend stocks offer a convenient way to diversify your dividend holdings. These funds typically invest in a basket of dividend-paying stocks, providing exposure to a wide range of companies and industries.

-

Dividend Aristocrats: Dividend Aristocrats are companies that have consistently increased their dividends for at least 25 consecutive years. Investing in Dividend Aristocrats can provide a sense of stability and reliability in your dividend income.

-

Regular portfolio review: To ensure your dividend stock investments remain aligned with your financial goals, conduct regular portfolio reviews. Monitor the performance of your holdings, analyze dividend trends, and make adjustments as needed.

Online Tools for Dividend Investing

To streamline your dividend investing journey, there are several online tools that can assist you along the way. Here are some popular tools worth considering:

-

Funnel Builder: Use a funnel builder like ClickFunnels to create landing pages and sales funnels to promote dividend investment opportunities.

-

Website Hosting: A reliable website hosting service like Bluehost ensures that your dividend stock blog or informational site is always accessible to your audience.

-

Email List Builder: Tools like ConvertKit or Mailchimp can help you build an email list of potential investors interested in dividend stocks. Regularly send them valuable information, insights, and investment opportunities.

-

Canva: Canva is a user-friendly graphic design platform that allows you to create visually appealing visuals for your dividend stock presentations, blog posts, or social media campaigns.

-

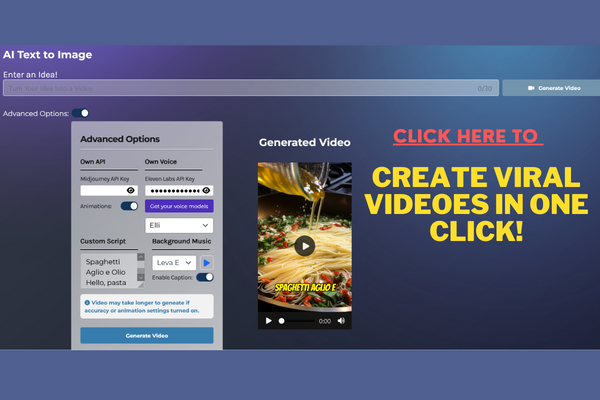

Invideo and VidIQ: These video editing and optimization tools can help you create engaging videos related to dividend investing and maximize their reach on platforms like YouTube.

It’s important to note that some links in this article are affiliate links, meaning the author may earn a commission from purchases made through those links. However, rest assured that all recommendations are based on genuine expertise and research.

Conclusion

Making money with dividend stocks can be a rewarding and lucrative endeavor. By investing in stable, dividend-paying companies and implementing proven strategies, you can generate a steady stream of passive income and potentially grow your wealth over time. Remember to conduct thorough research, diversify your portfolio, and leverage the power of online tools to enhance your investment journey.

Now that you have a better understanding of dividend stocks and how to make money with them, it’s time to take action. Start your research, set your investment goals, and embark on your dividend investing journey with confidence.

FAQs

1. What is the minimum investment required for dividend stocks?

The minimum investment required for dividend stocks varies depending on the company and the stock’s price. Some dividend stocks may have a higher share price, requiring a larger initial investment, while others may be more affordable. It’s essential to research individual stocks and assess your own financial situation before making any investment decisions.

2. How often can I expect to receive dividend payments?

Dividend payments can be made on a quarterly, semi-annual, or annual basis, depending on the company’s dividend policy. It’s important to check the company’s historical dividend payment schedule to get an idea of when you can expect to receive payouts.

3. Can I reinvest my dividends automatically?

Yes, many companies offer Dividend Reinvestment Plans (DRIPs) that allow you to automatically reinvest your dividends into additional shares of the company’s stock. This strategy can help maximize the compounding effect and accelerate the growth of your investment portfolio.

4. Is investing in dividend stocks risky?

Like any investment, investing in dividend stocks carries some level of risk. While dividend stocks are generally considered less volatile than growth stocks, they are still subject to market fluctuations and specific company risks. It’s crucial to diversify your portfolio, conduct thorough research, and regularly monitor your investments to mitigate potential risks.

5. Can I live off of dividend income alone?

Living off dividend income alone is possible, but it depends on various factors such as the size of your investment portfolio, the dividend yield of your stocks, and your financial goals. It takes time and careful planning to build a portfolio that can sustain a comfortable lifestyle solely through dividend income. Consulting with a financial advisor can help you assess your specific situation and create a realistic plan for achieving your income goals.